What is considered a structured settlement? How to sell a structured settlement?

Selling My Structured Settlement Payments

How to sell a structured settlement, The structured settlement can be sold to a factoring business to receive cash in a matter of minutes. However, you need to first get the approval of the court, you do have the legal right to sell your settlement in any form, whether it is part of or in their entirety for an individual buyer of a structured settlement. In accordance with the terms of your settlement, you might also be able sell survivor benefits.

Structured settlements are tightly controlled by federal and state laws. However, this strict restriction should not be taken as proof the sale of your settlement could impact your financial situation. However the possibility of getting the cash lump sum through the transfer of your rights to pay will help you reach goals in your finances that otherwise would be beyond your reach.

How to Sell a Structured Settlement: Key Considerations

If you’re considering selling your structured settlement payment we suggest that you seek the assistance of a reputable financial or legal advisor who has expertise in the secondary market for structured settlements. They can assist you in finding a reputable factoring business with a proven track record of safeguarding the long-term interests of its customers.

PRO TIP

Check with the office of your state attorney general or the consumer protection division of your state to verify that the factoring service you select has no complaints in its the file.

The settlement terms as well as the laws in your state will determine if you are allowed to sell your payment. State laws that are part of the Structured Settlement Protection Acts are intended to shield the recipients of settlement from fraudulent buyer of structured settlements. The protection you receive is another reason to be able to get your sale approved by a judge.

All sales of structured settlements require the approval of a judge. The judge will look at the specifics of the sale, whether you’re selling any of your settlement payments or a portion from each one, or the entire structured settlement and how the sale could impact your long-term financial position and the possibility that you’ll be facing financial hardship if you don’t receive the regular installments from your settlement.

The judge could be able to consider:

- The cost of living

- Future financial obligations like college tuition

- Your life expectancy

The process of court approval takes between 45-60 days.

While federal and state regulations have been put in place to safeguard the buyer from signing a contract that could cause you to suffer financial burden, you have to be accountable in your own financial destiny. You are more aware of your objectives than the court or buyer’s representative. You must decide what’s best for your family and yourself.

Consider the potential consequences of selling your monthly payments. The sale may alter your retirement plan as well as your eligibility to Social Security or other government assistance programs, as well as your tax obligations.

How Much Is My Structured Settlement Worth?

It is technically the current value of your contract however that’s not the amount you’ll get if you decide to sell your payment.

The factoring company calculates your current value with a formula which considers the value in the future for your payment — since the business won’t receive the funds until a time in the near future and subtracts the possibility of growth that the business will miss out on due to not having the funds on the bank to invest it immediately.

By using this method, the business determines what is known as the “discount rate.” The discount rate is the amount of that companies pay to account for the inherent risk that comes with the money they get in the future. The discount rate usually falls between 9 and 18 percent.

Additionally to the current worth of your transaction the company will also take into consideration the number of transactions you’re selling, the date of your transactions in relation to current market rates, economic conditions, as well as any fees for service that are related to the transaction in order in order to calculate the discount rate you’re entitled to.

You can obtain an estimate using an spreadsheet for structured settlement however, bear in the mind that no calculator will accurately reflect the exact conditions of the contract. Consider the estimate as a base and anticipate quotes to differ in the buying businesses.

What Are the Benefits of Selling My Structured Settlement?

In a nutshell: the main benefit in selling your settlement structure is the liquidity.

While structured settlements can provide an assurance of financial security for a long time however, there are situations that require a huge amount of cash in a short time. If that occurs you can sell your structured settlements can save the day — often literally.

For instance, you might require medical attention immediately and are not covered by insurance. Maybe your bank is planning to take over your home. There are a myriad of financial difficulties is extensive, and at times individuals must decide between their future security needs and their immediate demands.

If you’ve come across the need for more cash than the regular payments you give you all at once, the advantage of selling a part of the settlement will be the lump that will allow you to cover the expense and provide peace of assurance.

The strain of financial obligations can cause several physical and mental health issues. Experts, like experts at Harvard Medical School have found a link between anxiety and stress to heart disease and other cardiovascular circumstances. If you decide to sell your structured settlement will alleviate anxieties, then the advantages go beyond financial benefits and extend to your overall health and well-being.

However, it’s not just the financial strain that drives individuals to sell the structured settlements they have received. If you’ve received a settlement following a personal accident that didn’t cause your inability to earn income and you are not relying on the payments in the same like someone who is not able to return to work could. As a financially stable, employed adult, you are entitled to the ability to take your own financial decisions.

Selling a Minor’s Structured Settlement

The most cautiously guarded settlements include those that cater the opportunity to youngsters. If a child who is under 18 years old received the structured settlement of an injury-related case and the circumstances have significantly changed after the settlement was imposed the parent or guardian can offer the rights to future payments, however, the responsibility for proof is very high.

Parents or guardians have to prove convincingly to the court that there is a pressing need to cash, and the kid is more benefitted in selling the deal instead of accepting future payments.

PRO TIP

Certain factoring companies don’t purchase the structured settlement payments that are designed to help minors.

More Questions About Selling Your Structured Settlement

Now that you’ve mastered the basics of the sale of your structured settlement but you could still be unsure.

If you’re unable to get the answers you need within the annexes of commonly asked questions you can contact an agent of a structured settlement buyer for a discussion of your choices.

Do I have to get a judge’s be able to approve for the purchase of my settlement?

The judge has to accept for the selling of your settlement. In contrast to commercially-available annuities the structured settlement annuities are dependent on the approval of a judge. This doesn’t mean that it is unlawful to sell the annuities. selling your approved structured settlements is legal if a judge allows the sale. There instances where judges will not allow sales of the settlement. It is usually the case when a judge finds the sale is not in your best interests or the best interests of your dependents and family members.

What are my options for selling?

The options for selling your structured settlement include the selling of the total settled settlement that means that you do not have the right to future payments or selling one or a set number of payments or a certain dollar amount. Selling only a fraction of your settlement means you’ll still receive regular payments, which will either resume at the time of the payment you sold or continuing at a lower amount with no interruption.

Are I taxed when I sell my structured settlement?

In the majority of cases, however tax is due on the money you receive from the buying company won’t get assessed tax. However, certain exceptions do apply. In the words of IRS the compensation for wages lost in the event of emotional distress, discrimination without injuries or illnesses and punitive damages can be taxed. The IRS further declares it is “interest on any settlement is generally taxable as ‘Interest Income’ and should be reported on line 2b of Form 1040.” Tax-deductible structured settlements are not common however, before selling your settlements, you should check the details of your contract with an lawyer.

Do I have to pay an interest rate if decide to sell my payment?

Factoring companies offer discounts on the sale of structured settlements. Discount rates vary between 9 to 20 percent. The discount rates are meant to reduce the risk taken by the buyer during the transaction.

How long will it take to market my money?

The time needed for you to sell your payment is contingent upon a variety of variables. The state laws you are in and the capacity of courts to consider and decide on the sale are the primary factors. Furthermore, any omissions in your documents could cause delays to the sale.

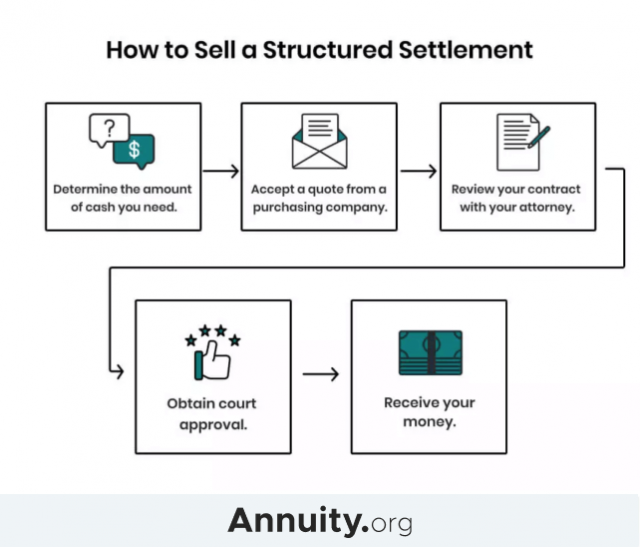

How to Sell Your Annuity Payments in Five Simple Steps

If you want to sell annuity or settlements for cash today take a straightforward step-by step procedure that includes researching buying businesses, comparing offers and finally selecting a reputable buyer. Selling structured settlements requires a second step — obtaining the approval of the court prior to your transaction being completed.

The process of selling annuities and structured settlements is easy. However, before you start you should take a careful examination of your situation and determine whether you really need the money right away.

If yes, then you need to be well-informed, prepared as well as in charge.

Also Read:

Best ways how to automate accounts payable 2022

Best Ways how long to keep mortgage refinance documents 2022

How long to sue for medical malpractice 2022

How to block emails on icloud 2022

Best Ways how to choose a mesothelioma lawyer 2022

There are a few important differences in the procedure for selling commercial annuities and the method to sell structured settlements. To comprehend these differences it is important to first recognize the fact that Annuities as well as structured settlements do not mean the same thing.

Annuities are insurance policies which can be purchased through an insurance agent or company. They are often purchased to be part of their retirement plan to ensure an income during their retirement.

Structured settlements, on contrary, are regular settlements negotiated by the plaintiff and defendant in personal accident and wrongful death lawsuits to cover the plaintiff’s loss.

They are usually managed by a registered structured settlement broker, who makes use of an annuity or other suitable source of funding to make the settlement.

Their legal status means that selling annuities based on structured settlement is somewhat more complex than commercial annuities, however for the majority of the time the procedure is similar.

If you want to pay off your commercial annuity or other annuity, you may either surrender the contract, or sell your payment to a third party company.

However, if you require funds out of your structured settlement the only choice is to choose a buying firm — also referred to as a factoring businessthat will purchase all or a part of your future installments in exchange in exchange for a lump sum cash.

Step 1: Do Your Homework and Research Buyers

A simple search on the internet can be a good method to begin looking into purchasing businesses. Do your research to locate an investor who will offer you the top customer service and the best price. Find a business that has positive reviews on the internet and an excellent score by the Better Business Bureau.

Also, make sure to seek advice from an expert in accounting or planning your finances. Make every effort to locate a trustworthy buyer who will answer any questions you might have.

Step 2: Consult a Representative and Get a Free Quote

After you’ve identified some credible buyer of the structured settlement begin making calls. Contact the customer support representatives, who discuss the selling options in a clear way, without jargon that confuses. Request each company to provide an estimate for a no-cost quote.

PRO TIP

It’s okay to inform prospective buyers of payments that you’re receiving quotes from a variety of firms. It is possible to get a higher estimate if the company is aware that you’re seeking the most competitive price.

Meet with at least two purchasers of structured settlement and compare their rates. Make sure you verify what they tell you through your own study.

Contact us to find out the value of your annuity or structured settlement is worth. We are able to recommend buyers who are reputable.

Do not let anyone push you. Explore your options, and make the best choice for your family and you.

Step 3: Consider and Accept an Offer

Examine your proposal then compare it with others and then accept the one that is most appealing.

If you’re in possession of an arrangement for a structured settlement, it’s crucial to be aware that you’ll be selling your settlement rights at a reduced rate depending on the firm you select. The lower discount rate and the lower it is, your, as the seller, will gain since your payment rights will have more value in cash. The more discount rate you can get is, the more the buyer will profit.

Discount rates can be discussed however, the majority of buyers have a standard rate they usually adhere to when they offer an estimate. The average discount rate is between 9 to 18 percent in accordance with the National Association of Settlement Buyers.

If you’re making a cash withdrawal from an commercial annuity and selling the proceeds to a factoring business on the secondary market may be more advantageous instead of withdrawing the money that could result in surrender fees and possibly tax penalties, based on your age as well as the duration of the annuity.

Step 4: Complete Paperwork

The purchaser along with your company’s insurance provider will complete the paperwork required for the sale of commercial annuities. After you’ve completed all the paperwork to transfer title of the owner and the designation of the payee on to the purchaser, the remainder of the process will take about four weeks.

If you plan to sell future structured settlements, you’ll need to supply the necessary information and fill out forms. It is also necessary to provide a copy of your original structured settlement agreement to the factoring firm.

If you have lost the original contract, you should contact the insurance company that issued your checks . They will send you the policy. You can also get in touch with the lawyer who helped negotiate the settlement.

Documents You’ll Need to Sell Your Structured Settlement:

- Two types of identification

- Application is complete

- Original copy of the structured settlement contract

- Release agreement

If you accept the cash deal, the factoring company will mail you documents for the transfer to sign and notarize. The faster you send these forms back, the faster you will receive your cash.

Keep a record of transactions in a secure and easily accessible place.

Step 5: Get Approved and Receive Your Money

The insurer that issued the contract must be able to approve the commercial annuity. As long as the transaction is legal and the buyer is trustworthy, the insurance company will accept your offer, and you’ll receive your cash as soon as the law permits.

It can take between 45 to 90 days in the average for the sale of structured settlements. Certain states require that sellers be assessed by a professional about the sale from an independent third party, whereas other states allow the possibility of a “cooling period” during which you are able to decide to reconsider the sale. It is advisable to consult with your attorney or financial advisor on the specific laws of your state prior to finalizing the sale.

Court Approval: The Extra Step for Selling Structured Settlement Payments

Sales that are structured settlement need an extra step. A judge will look over your sale and then speak with you to decide if the sale is in your best interests.

After you return the signed documents an attorney in your local areaeither one you employ or selected by the factoring firm will file the papers with the court in order to request hearing. The process of waiting for a court date can take as long as 60 days following the filing of all signed documents, however it will depend on the location you reside in and what’s already on the docket of the court in the area you live in.

DID YOU KNOW?

There is no court date necessary if you sell the proceeds of an annuity that you purchased through an insurance firm.

The court date is probably the primary factor in the time it takes to receive cash from the sale of structured settlements. If you require funds quicker then you might be able to get a cash advance from the factoring firm within a couple of days.

Every state has their own regulations and laws according to the Structured Settlement Protection Acts. The laws are designed to safeguard the consumers from fraudulent factoring companies on the extremely competitive secondary market.

Regulations differ from state state, but they may also require you to consult an attorney or outside counsel prior to settling an agreement.

If you’re given an appointment to hear the case and accept your sale, you’ll be before the judge. Prepare to discuss why you need to sell your property and show that you’re not putting your family members in financial risk.

Your arguments into consideration when evaluating the case, along with other elements like the credibility of the purchasing firm, discount rates, status as an employee as well as any previous transactions.

In the event that the court agrees the issuer will then receive the transfer request to acknowledge the transfer order. The buyer of your structured settlement will then issue you with the lump-sum amount.

How to Sell a Structured Settlement

While it can take time and requires having to go to court selling structured settlements is much easier than you think. With the help of trusted advisors who can help your through this process you’ll be able to ensure that you’ve made the correct decision , and you will be protected from unscrupulous buyers.

Selling all or a part of your future structured settlements could be the most effective way to receive the money in one lump sum to pay for unexpected expenses, for example, a huge hospital bill or urgent improvement.

Some individuals refer to the type of transaction as it is a secured settlement loan. However, that term is not true since there is no structure for a settlement loan. The law currently prohibits the use of structured settlements as collateral for loans.

We’ve provided a complete description of the procedure of Selling your structured settlement So you are aware of exactly what to expect at every step of the way.

Evaluate Your Needs

First step: Determine how much cash you’ll need and the percentage in your structured settlement plan to market. Be aware that the amount of the money you’ll receive over the course of time will be more than what you get from a company who purchases all rights related to payment. This is because the business will incur legal and administrative expenses. Additionally, the company exists to earn a profit.

The lump sum that you receive from the factoring firm, could be as little as 50 percent of the total future payments, but it typically is between 60 to 80 percent. For example, if you earn 1,000 per month from an agreed settlement plan, then you may sell every payment for anywhere between $500 and $800.

Keep this in mind as you think about the amount you’re willing to forfeit and the length of time you’re willing to put off. The majority of people don’t sell their whole structured settlement. Instead, they sell a fraction of their payment. They could decide to offer six months’ worth of payment but they will not have a regular income flow from their structured settlements during that period.

They may also wish to continue receiving regular payments for the period of six months, in which case they could sell half of their annual payments.

The amount and duration of time is up to the person who is in charge. It is important to carefully assess your financial situation and think about the best option for you.

If you take the example of $1,000 monthly installments, you can choose to offer six month’s worth of payment, or $6,000. In that scenario you would not receive any amount out of your settlement for the six months. When the time is up and you’d be receiving $1,000 per month. This arrangement could result in an amount that ranges between $3,000 and $4,800 subject to the terms of the offer.

If you decided to sell the majority of your payment in the coming year, the amount will still be $6,000 however, in this case you’d be receiving each month $500 in payments instead of $1,000 for a full year. After six months, you’ll get your monthly $1,000 earnings.

The legal requirements for selling the structured settlement can delay the buyer’s payment of funds, which could affect the final price.

You must ensure that you are able to make enough sales to cover the obligation you’ll need to settle. If you don’t sell enough it will be necessary to begin the process over and be in front of the judge again to obtain additional funds. If this occurs, the judge could be skeptical about your capacity to manage your finances and could be less likely to accept the second deal.

Get Quotes

Step 2. Contact the business who will purchase the item called a factoring business to request a quote. This will inform you of what the factoring company will be willing to pay for your payment. It’s an excellent idea to obtain multiple quotes from various buying firms to ensure you’re certain that you’ve selected the correct factoring firm.

It’s an excellent idea to examine the rating of the businesses on the Better Business Bureau.

Be sure to include in writing all charges and commissions that the company will ask the buyer to make. It’s best to approach every transaction with your eyes wide open. After making contact with companies and receiving quotes, you’ll be able to get an idea of much you’ll receive in exchange for payments. Armed with this information you might want to revisit the first step.

Assess Your Options

Step 3. Compare the offers with one another. Take the time to read details and be aware of the terms of the deal prior to signing the contract. Check that all your concerns are answered and you feel comfortable working with the business you select. If you’re not sure, talk to someone who you trust to help determine your options. Don’t be afraid to ask additional questions.

Research the factoring companies until you’re sure that they’re trustworthy. Check their websites, speak with their representatives, and take a look at the professional associations that they’re a part of. After you’ve completed all research, choose which one is the best fit for you.

Select the Company

step 4: Select the most suitable deal and then complete and complete the form.

The documents required include:

- Two types of identification

- A fully filled application

- Original copy of the structured settlement and release agreement.

- Copies of your policy on annuities

When this step is finished and you’ve signed an agreement, you’re now legally authorized to sell your money.

Request an Advance

5. When you’re in need of urgent cash, request an payday loan. It will be a part amount of around $1,000 to help you waiting for the process to complete. It could take as long as three months before you get your lump sum payment.

Appear Before a Judge

Sixth step: Find legal approval from the courts. It may sound intimidating however it’s not. The factoring firm you’re working with will take care of all the arrangements and also prepare the documents that you will present to the judge of the county you reside in. You’ll be asked a few questions to convince the judge that the transaction will be in your greatest interests. This step is mandated by law. Apart from that the judge will look at the welfare and financial support of your dependents in deciding to accept the sale.

If the court has approved the transaction, you must forward a copy of the request to your administrator for the structured settlement.

Get Your Money

7. Pay the entire amount according to the terms of your contract with the factoring firm. The process typically takes 3 to 5 business days following getting the approval of your court.

If you have outstanding child support, or have tax liens, these are subtracted from the lump sum prior to when you are able to receive the cash.

How to Sell Your Structured Settlement Payments

If you’ve settled in a tort or personal injury claim, your future installments from the settlement will likely be a crucial asset. If a major cost arises, you’ll be in a position as many Americans are with their limited savings will not be enough to cover the unexpected costs. The settlement funds could be the only solution to cover your financial needs.

There is no method to reverse a structure settlement agreement, and instead receive an unrestricted lump amount. But the positive side is that sellers with certain qualifying structured settlements have the option of transferring the rights to their future settlements in exchange for cash today. If you sell all or a portion of your future payments this option could provide you with the required lump sum cash payment.

We’ll go over the requirements necessary for the transfer of right to payments in the future from a structure settlement an investor or buyer and also the laws in force that might be applicable to your specific situation. CrowFly’s tools along with its transaction navigators’ team are on hand to assist sellers such as you to understand what to expect from the process of transfer and, even more important give you information about alternatives to look into first.

Evaluate Your Best Interest Regarding Your Structured Settlement

It is crucial to establish if trading structures settlement payments is the right option for you. Transferring rights or “selling” future structured settlement payments, is an irrevocable procedure. After the transfer has been completed as well as that you (the seller) are paid in exchange for all or part of your future payments there is no way to return to receive the scheduled future payments. Selling structured settlements is a significant decision that must be thought-through. Experts at CrowFly will help you determine whether selling future payments is the best option for you.

In deciding if selling your structured settlements is the best option in your case, you should consider these questions:

Do you require cash now to cover an emergency or another urgent need?

Examples of an immediate need could include:

- Medical emergency

- Family dynamics (expecting the birth of a baby or losing the caregiver)

- Returning to school

- Moving your family

- Critical home repairs or replacement of a car

What portion of the future installments do you need to dispose of to cover your current requirements?

Future settlement payments that you sell will incur the possibility of losing value. Therefore, ensure that you’re doing not sell more that what you really need. In addition selling your payment multiple times can increase fixed cost of the transaction It is important to stay out of the situation of selling several times in a short amount of time.

CrowFly offers an Free calculator that allows users to instantly and discretely calculate the value of future structured settlements so that they can decide if it’s worth considering the possibilities of transferring rights.

Are there other ways to pay for this instant cost to be able to receive the structured settlement payments?

CrowFly is not a recommendation for any specific vendor, however there are a variety of banks, financial advisors and lending companies that you could talk to. For instance, personal loans can be a viable option however they may vary wide in terms of interest ratesbetween 5% and over 30% and selling your loans typically costs less than the 6% rate..

Think about the local bank. If you’re able to get an equity loan for your home and pay interest, the rates will be much lower. A bank said they had APRs (similar to interest rates) varied between 9.375 percent to 4.275 percent (as on 1/15/2020).

- You can check the quoting of resources like NerdWallet or Bankrate.

- There are platforms that aggregate loans, like Prosper or LendingClub..

Do I have to sell the right to future structured settlements affect my financial security?

If you require the monthly installments from your settlement to survive then we suggest to not sell the funds. Explore other options or consult with a financial planner. If you have none other options, consider selling the most expensive payments out however only after you have created the plan of how you will cover the loss in income.

Can You Legally Sell Your Structured Settlement Payments?

Some sellers are not able transfer the rights to future structured settlements. Prior to moving ahead, you need to ensure that the asset you own is actually an organized settlement. For those who have claims for workers’ compensation and social security payments or other settlements that aren’t approved by the courts are not eligible to transfer, so make certain to read your policy.

To be eligible, you must have future payments coming from the settlement defined in the 26 U.S. Code SS 5891. Factoring for structured settlements:

- “structured settlement” or “structured settlement” means an arrangement that is negotiated through:

(i) the suit, or agreement to make periodic payments of damages not deductable in the income gross of the beneficiary under section 104(a)(2) (ii) suit or agreement for the periodic payment of damages exempt from gross income under

(ii) agreement to make periodic payments of compensation under any worker laws that are exempt from his gross earnings as a recipient as defined in section 104(a)(1) and where these periodic payment are (i) in the nature that is described in paragraphs (A) as well as (B) in section 130(c)(2) and

(iii) to the person who is participant in the agreement or suit, as well as to the claim for workers’ compensation, or by a person who taken on the obligation for the periodic payments in accordance with an assignment that is qualified pursuant to section 130.

Free, no-obligation quote and guidance from CrowFly

CrowFly is dedicated to delivering an experience that is built upon trust, ease of use and openness for all individuals and families that have settled settlements that are structured.

Federal Law

The federal government refers to the procedure “structured settlement factoring transactions” under this law. In essence selling a structure settlement has to be approved prior to the sale by an order from a judge within the proper location (meaning the state where you reside). In order to qualify under federal law the court must also confirm that selling the settlement is not in violation of a court order or law, and you are in the best interests and in the best interests for your family members.

State Law

Every state has its own regulations regarding the transfer of rights to structured settlements. For instance, certain states have waiting periods that must be met between receiving quotes and signing a sale contract. Certain states require that all documents be signed by a person in person, while others allow electronic signatures. CrowFly has put together an state-by-state guide to guide potential buyers to the law that applies to the state they are in. Please feel free to contact CrowFly directly to get assistance.

Choose a Transfer Company

If you think a transfer is the best choice for you and is allowed under both state and federal law the selling process might commence. There are a variety of companies to transfer rights to future structured settlements. Every company must abide by the state and federal laws, and also work with the insurance and court that will be assisting you with your payments. However, every company will take a different approach to the process and may result in an entirely different amount at the final.

It is beneficial to reach out to companies that factor structured settlements for quotations. For a quote request from CrowFly you can visit our start page. It is not a requirement to avail CrowFly’s services. Instead, sellers are encouraged to spend enough time to review every one of the quotations they get.

When deciding which company to proceed with, it’s important to be aware of each firm’s discount rates. The discount rate is the percentage of you’ll be considered to be paying on a year-round basis to calculate the value of your present that the factoring or buying company will be willing to pay. Some see this as being similar to the interest rate you pay by a loan. This is not the case, but it’s is a useful and familiar comparison the less expensive the interest rate is, the greater amount you can keep. But the more expensive your rate is, more you’ll lose.

Certain businesses purchase future structured settlements and payments to keep them in order to directly receive the assets. Some buy future payments and then package them into bundles to sell to big institutions in large quantities. CrowFly is a platform that connects sellers directly with a new category of buyers: individuals investors. In addition, by expanding the pool of buyers it allows us to have greater competition for your payments and, as a result, more attractive prices. The more people are planning to buy guaranteed, stable and reliable fixed income in the near future more favorable bargain you will get.

Formalize the Sale

When you work with a firm to sell your settlement payment You will be required to fill out or supply various documents. The details may differ the submission of certain documents is required for:

- Check if you have the authority to market structured settlements,

- Verify that you have all the necessary information to make a sound choice as well as

- Allow the court to be able to approve the process.

Imagine it as buying the house you want to live in. Everyone involved must ensure that all papers are correct. The list of things to be included could be daunting However, CrowFly is there to assist.

The documents required are:

- Annuity Insurance Policy, or Beneficial Verification LetterIssued from your insurer, the document details the specifics of the annuity, which includes the details of the payment stream.

- Authorization LetterThe form in which you give permission to CrowFly to get certain details regarding the structure of your settlement.

- disclosure statement:Legally mandatory as part of each structured settlement transaction, the document details the terms and conditions of the transfer.

- Buy and Sell AgreementThis is the arrangement between the parties to the transaction and CrowFly concerning the structured settlement and conditions that govern the sale. It details the various terms and conditions.

- Statement of Professional Advice from an Independent Source:Some states have requirements that sellers seek independent professional advice. Other states allow you to abstain from this obligation in writing. This document explains what you’ve chosen to do by seeking professional advice.

- Declaration of Marital Status:This document includes information regarding your present and past marital status.

- Declaration of DependentsThis document provides information about your dependents that are in your name.

- Spousal ConsentThis document is proof that your spouse’s, should you have one, agreement to this transaction. Identification: Any photocopy of a photo issued by the government ID, like your driver’s license, a government ID card or passport, can be accepted.

- Financial ApplicationThis will allow you to market your rights to structured settlement payments.

- seller wiring instructionsHere you’ll specify the manner and location you’d prefer to receive your lump amount. The document is then notarized and signed.

Every state has its own unique rules that require these documents or other ones.

Personal information will not be given to the individual buyer. The details are sent to your local court as the form of a petition which CrowFly assists in filing. A judge from that court will set a date to look over the petition in which they confirm that you want to go ahead with the transaction and also that your financial situation is urgent enough to warrant selling the payment.

If the court is satisfied that all is in order, the judge will issue an order directing an insurance firm to give the rights of subsequent payments over to the purchaser of the structured settlement.

Get Paid

After the judge has issued an order The insurance company will then confirm for the customer that they’ve made the transfer. After that you receive the money direct to the bank account you have.

Structured settlements are intended to supply long-term financial resources however, should your situation change, selling a portion of your installments might be the best option for you.

Annuities that are structured settlements are great alternatives in personal injury lawsuits because they are tax-free, and they guarantee an income for a certain period of time. However, the agreements for structured settlement are not enforceable and do not permit unplanned modifications. In these situations most structured settlement payers decide to sell a portion or even all their annuities for a substantial cash lump amount.

There are many reasons an individual might decide to sell an Annuity with a structured settlement for example:

Paying Off Debt

Credit with high interest, like credit card loans, may quickly result in poor credit scores, which can hinder future purchases.

Funding an Education

The trade school and college are costly. Many people have to take on the burden of student loans when they go to college or taking their kids to school.

Making Home Repairs

The homes require a lot of care to keep it in good shape or increase value. Remodeling, upgrading appliances , or changing the roof can cost thousands of dollars.

Buying a Home

It is dependent on the region and the credit score of the buyer A down payment on the home can cost tens of thousand of dollars.

Starting a Business

While a business may earn substantial profits over time, new companies require a substantial amount of initial capital and banks are typically reluctant to offer business loans to entrepreneurs who are just starting out.

Investing

The investment in a company or stocks can pay high dividends and help save for retirement.

Paying Taxes

If the back balance of business, property or income taxes accumulate and accumulate, it could lead to negative credit scores, lien, or garnishments.

How to Sell Your Structured Settlement

Our CBC Settlement Funding team has more than 50 years of expertise and we are able to comprehend the specifics of the process of selling a structured settlement. We believe that the process should be reduced to five simple steps.

Step 1

Decide to Sell Your Structured Settlement Annuity

If you’re facing financial difficulties or are looking to make an investment which will greatly improve your lifestyle selling your structured settlements could be the best option to you as well as your loved ones. It’s your legal right to do so, subject to the process of court. It is essential to determine the reasons for selling prior to commencing the process to ensure that the judge will be able to approve your argument and decide whether the sale of an agreed-upon settlement in the best interests prior to approving the sale.

Step 2

Shop Around for a Funding Company

CBC Settlement Funding is one of the many funding firms within the U.S. Our clients select us because we provide outstanding customer service, free estimates, low-cost discount rates and cash advances. Customers should also search for the funding company that has an outstanding Better Business Bureau rating -the BBB offers CBC Settlement Funding an A+ rating. We encourage all of our clients to evaluate companies and quotes before making a final decision.

Step 3

Begin the Structured Settlement Sale Process

If you decide to offer your structured settlement settlements in to CBC Settlement Funding, your personal representative from CBC will go over the available options and help you in choosing the most suitable one to meet your needs. The quotes we provide are free and there is no obligation. If you decide to move ahead with the process of selling our agents will draft all the paperwork you need to fill out. The documents you’ll need to submit and submit to our lawyers include an application identity, identification, annuity agreement as well as a settlement agreement and the benefits letter.

Step 4

Submit the Structured Settlement Sale Application

Once you have completed and signed the forms The lawyers of CBC Settlement Funding will file the documents in the courts. In the next up to three weeks the court will look over the documents and decide on an appointment date. Remember that this process will vary from state to state as the laws for selling structured settlements are different. CBC is among the most high approval rates for these types of transactions in the business.

Step 5

Get Your Cash

When the court examines and approves the transaction once a definitive court ruling has been issued you will receive your funds within 48-72 hours. CBC Settlement Funding offers payment through electronic transfer or by check.

Getting Advice From A Lawyer or Accountant

CBC Settlement Funding makes selling an annuity that is structured settlement simple but it’s still a legal one. We always advise our clients to consult with their legal counsel prior to proceeding with an annuity purchase. If you’re your own accountant, tax or advisor we recommend that our clients seek the advice of these experts.

Your accountant or attorney can provide an additional layer of the process since they understand your specific situation and can assist in ensuring that the sale of your structured settlement annuity is best for you. The specifics of selling annuities differ between states and therefore your accountant or attorney will be able to address any questions you have regarding the sale of your structured settlement within your region.

Sell Your Structured Settlement Annuity For Cash

We recognize that your financial requirements will alter over time, which is why CBC Settlement Funding is proud to offer choices that will meet your needs in terms of finances, like buying a part or the entire annuity in one lump sum of cash. If you’ve spoken with your accountant or lawyer and are convinced that selling your structured settlement is the best choice for your family and you contact us now.

CBC Settlement Funding provides free quote on purchases with competitive rates and sometimes advance cash in the first 72 hours. We simplify the legal process. We’ve earned our clients trust for close to 75 years of expertise in the field and are pleased with our A+ rating from the Better Business Bureau.

Length of Time Required

It’s difficult to know the time it takes to get the lump sum sum you want because selling your installments is a legal act. Every state’s law that governs selling structured settlements differs which will influence the amount of time it takes to finish the transaction. However, generally speaking the entire process can take between 45 and 60 days.

CBC Settlement Funding

Know Your Selling Options

There are many options to take advantage of your structured settlement. Make sure you compare your options before accepting the offer of a potential buyer. Although you can certainly sell the entire structure settlement, there is no need to. Instead, you should consider selling only some of your settlement in advance and continue to receive an amount that is lower throughout the time.

In a partial sale you’ll be able to sell a certain amount of your settlement. When the period is over then you’ll be re-initiated as the owner of the settlement, which means you’ll still be able to benefit from the funds that are long-term. On the other hand, achieving an equilibrium may make it feel like there’s little or no negative financial impact on your life in the short term and in the long run.

If you decide to sell the entire settlement amount, you have the flexibility to use this large amount now in the method you’d like to. The downside is that you won’t be able to get the cash back. If you experience a investment-related emergency or financial crisis is to occur, you’ll have to employ other methods to deal with these problems when the time comes. In any case, it’s crucial to prepare for the future and utilize your money wisely regardless of the time you get them.

Process of Selling Settlement Payments

Although the quality of the process is dependent on the buyer of your structured settlement but the general process is the same regardless of which you choose. These are the three major aspects of selling your structured settlement to let you know what you can be expecting.

- Get to Request a Quote Begin by getting started by getting cash-out estimates from various structured settlement firms. It is crucial to comprehend the details of what you’ll be receiving and when you can expect to receive your funds. Make sure you make sure that all promises are in written form. If not, you could be caught by surprise shock when you sign the commitment, but don’t get the same conditions you had been given.

- Get Court Approval If you decide to select an organization to purchase your structured settlement an appearance in court is scheduled to have a judge approve the transaction and confirm that the purchase is beneficial to your financial wellbeing. It is possible that you will be required to attend a hearing before a judge or permitted to have the buyer represent on your behalf. It is contingent on the services your business offers and the laws of your state allow.

- Get Your Money Then you won’t get the cash you received from your structured settlement immediately following the court appearance. The first step is to contact your insurance company in order to notify that they are aware of your sale. The distribution of the lump-sum will be planned. The time it takes to complete this process will depend on the firm you select. The payment options you have are also different according to the payment methods provided by the buyer.

When It Makes Sense to Cash Out a Structured Settlement

The terms of structured settlement naturally are restrictive, as the recipients are being entitled to payment on the basis of a specific timetable. There are numerous situations that this arrangement is no longer suited to the requirements of the person receiving it. In most cases, when people opt to take cash out of their structured settlement in the event of an the need for money urgently.

In some cases, people are unhappy with the decision to use a structured settlement over the lump sum and would like to change their decision. Whatever the reason, there’s an option to receive cash in exchange for your structured settlement.

The most frequent reasons to cash on a settlement structure are:

- purchasing a house

- purchasing a car

- funding education

- paying off the debt

- making a bet in a company

There are many options to take advantage of your structured settlement. Make sure you compare your options prior to accepting any offer you receive from a potential buyer. While you could certainly sell the entire structure settlement, you do not have to. Instead, think about selling only some of the settlement up front and then

In all instances you shouldn’t feel limited by the timeframe of your payments in the structured settlement. If you require access to your funds immediately There are a variety of alternatives to choose from.

Factoring firms, or companies who buy structured settlement payments are able to offer you the option of a lump sum payment to cash out your remaining payment. They will evaluate the worth of the remaining payments from your structured settlement and are able to quickly offer a quotation on their purchase cost.

In cashing out the structured settlement payment the buyer is unable to get the full value of the payment from the purchaser. The buyer is always willing to offer an amount that is lower than the value. The variation between structured settlements and the amount of the lump sum that is offered by the seller is known as the discount rate. Read on to find out more about the discount rate.

Understand the Discount Rate

Although the caliber of the process can vary based on the type of buyer you have chosen for your structured settlement but the general process is the same regardless of which you choose. The following are the three primary aspects of selling your structured settlement to let you know what you can be expecting.

If you are taking a look at the quotes of potential buyers for the structured settlement you have, it’s important to comprehend the significance of discount rate. Contrary to the majority of cases, such as when you’re shopping at a sales – it is important to be aware of an affordable discount rate!

This might seem odd initially, but it’s important to be aware how the discount rates are the sum lower than the value of the structured settlement that you receive. That is, it is the sum that is less than the total amount you receive as a lump sum by the purchaser.

Factoring firms consider a range of elements in calculating the discount rate that they are able to offer to potential customers. This includes the total amount of the sale the amount of money, the number of payments that are due, the current interest rate as well as the timeframe for when the payments will be made as well as any additional fees the factoring firm wants to charge.

The discount rate is never zero. A factoring firm will never provide you with a lump sum payment to cover the entire amount of the remaining installments for the structured settlement. Discount rates differ between purchasers of structured settlements, but it’s the cost clients pay to gain cash access now.

Structured Settlements Explained

Structured settlements are intended to assist those who have received settlements with managing their funds in order to improve their financial well-being. This kind of settlement came about as a an outcome of the fact that many settlement recipients spend their settlement funds quickly instead of investing them and slowly withdrawing them to pay their expenses over a long duration of time.

Settlements that are structured became popular in the late 1980s after new tax laws and regulations within the United States made all personal settlements for injuries and wrongful deaths tax-free. In consequence that, money people get from their structured settlements are tax-free.

If you are the beneficiary from a settlement structured instead of receiving your complete payment in one large lump sum you’ll receive regular installments over the course of. This is beneficial to the company or person paying the settlement as they can pay it over time. This also helps the person receiving it as it provides them with an assurance of their finances from the settlements.

Structured settlements are a result of a variety of kinds of lawsuits, but they are typically the result of Personal injury cases. They may also be negotiated when there is the settlement of backpay, divorce settlements, liquidation, and punitive damages. It is also typical that structured settlements are obtained in negligence and wrongful death lawsuits.

The owners of structured settlements are entitled to the option of selling them in exchange for cash. This can be accomplished by factoring companies that offer an all-in, cash, in exchange for the regular payment from the structured settlement. You can sell all structured settlements, be it result from medical malpractice, personal injury or another instance.

From beginning to finish, the procedure typically lasts about a week, but it varies dependent on the speed at which the hearing will be scheduled.